Property Tax Working Group

Purpose

The Property Tax Working Group was officially formed by a Council motion; however, the idea for the working group emerged when Carol Gibbs, President/CEO of the Mt. Auburn Community Development Corporation, approached Vice Mayor Christopher Smitherman with concerns about how to protect vulnerable homeowners and allow them to continue living in their homes while development occurs in their neighborhoods. From this partnership, the working group was formed with the aim to preserve the integrity of neighborhoods by protecting residents who have owned and lived in their homes for many years. The working group also aimed to assure that these residents, who may be in danger of losing their homes due to rising cost of property taxes, have choices that will allow them to continue living in their homes and neighborhood.

As directed by the Council motions, the Property Tax Working Group looked at trends and best practices that have been utilized in other areas of the country, especially those related to the issue of rising property taxes in areas experiencing significant levels of development and redevelopment, and made recommendations aimed at helping to keep senior and people living with disabilities in their homes and communities. The working group also proposed revisions to the City’s residential tax abatement program. Vice Mayor Christopher Smitherman and Carol Gibbs served as the working group co-chairs.

Process

Working Group Meetings

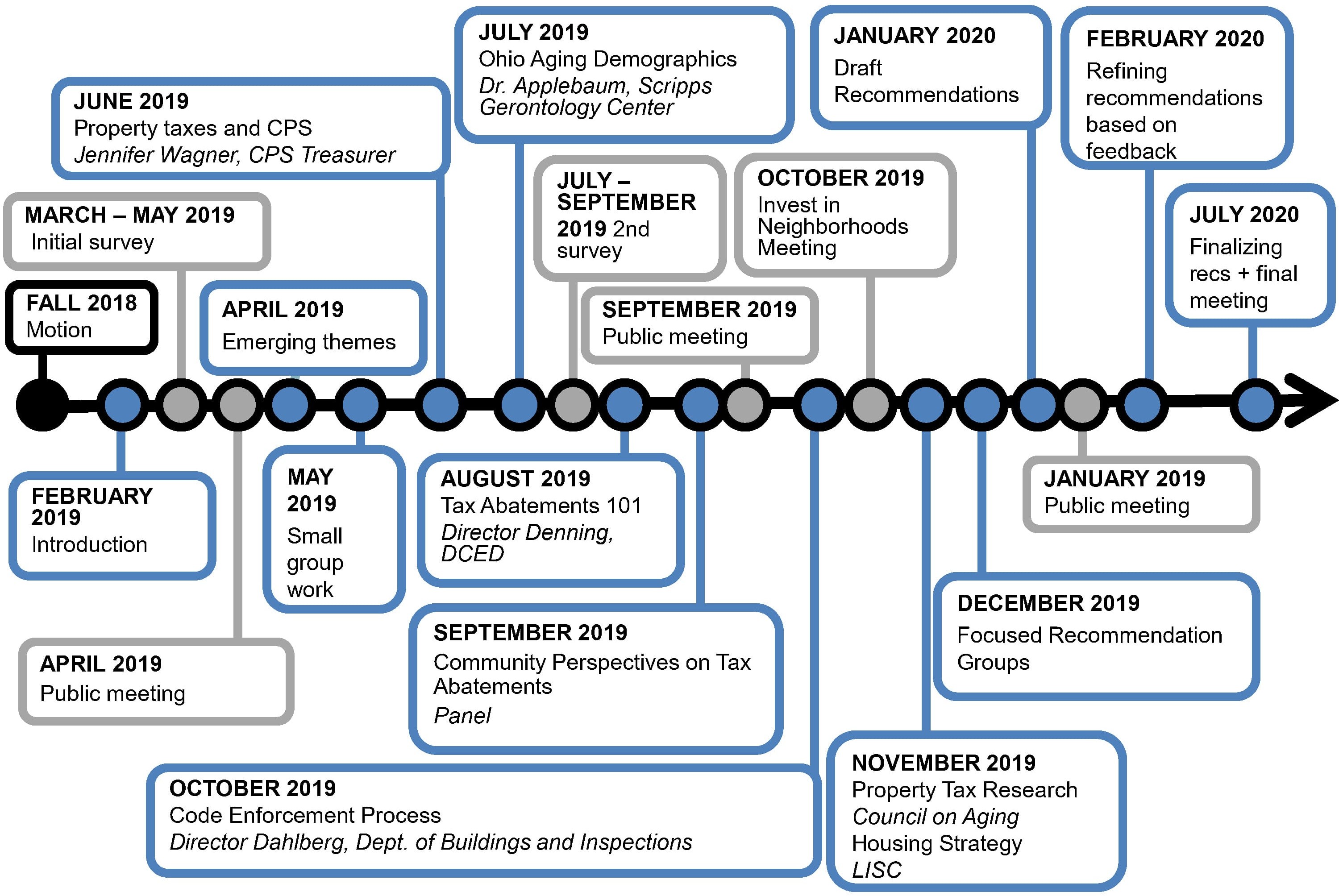

The working group started meeting in February 2019. 12 regularly rescheduled working group meetings were held throughout the process. In addition to regularly scheduled meetings, five special working group meetings were held for Focused Recommendation Groups to complete their work and for the final meeting. Due to precautions related to COVID-19, working group meetings were suspended from March – June 2020.

The working group initially met to establish goals and a foundation for their work. These were further informed and refined following a public meeting in April 2019. The working group then spent seven meetings (May – November 2019) educating themselves on topic areas and hearing from guest speakers who provided additional perspective. From December 2019 to July 2020, the working group operated in Focused Recommendation Groups and worked on writing and refining their recommendations for a final meeting on July 23, 2020.

Public Engagement

While all working group meetings were open to the public, there were three meetings specifically designed to garner feedback directly from community members and stakeholders. These meetings were held at almost equal intervals throughout the process as seen in the timeline below. As another method to gather feedback from community members and stakeholders, the Property Tax Working Group also conducted two surveys.

Recommendations

During the December 19th Property Tax Working Group meeting, the working group split into subcommittees called "Focused Recommendation Groups." These groups were charged with bringing recommendations to the January Property Tax Working Group meeting. The groups were as follows:

-

Group 1: Desired Property Tax Policy for Seniors and Living with Disabilities/Special Needs

-

Group 2: Support for Low/Limited Income Residents

-

Group 3: Residential Tax Abatement Policy Review

The Property Tax Working Group solicited feedback on these draft recommendations via an online feedback form and through a public meeting on January 30th. The Property Tax Working Group refined recommendations during the month of July and approved them at their July 23rd meeting. A Final Report outlining the process, recommendations, notes, and surveys was completed on September 9, 2020.

Materials

Council Motions

In August 2020, Vice Mayor Smitherman introduced the following motions based on recommendations from the Property Tax Working Group:

- Residential Tax Abatement Policy Recommendations

- Property Tax Policy Recommendations for Seniors/People Living with Disabilities/Special Needs

- Recommendations for Low and Limited-Income Individuals to Stay in Their Homes

- Residential Tax Abatement Caps